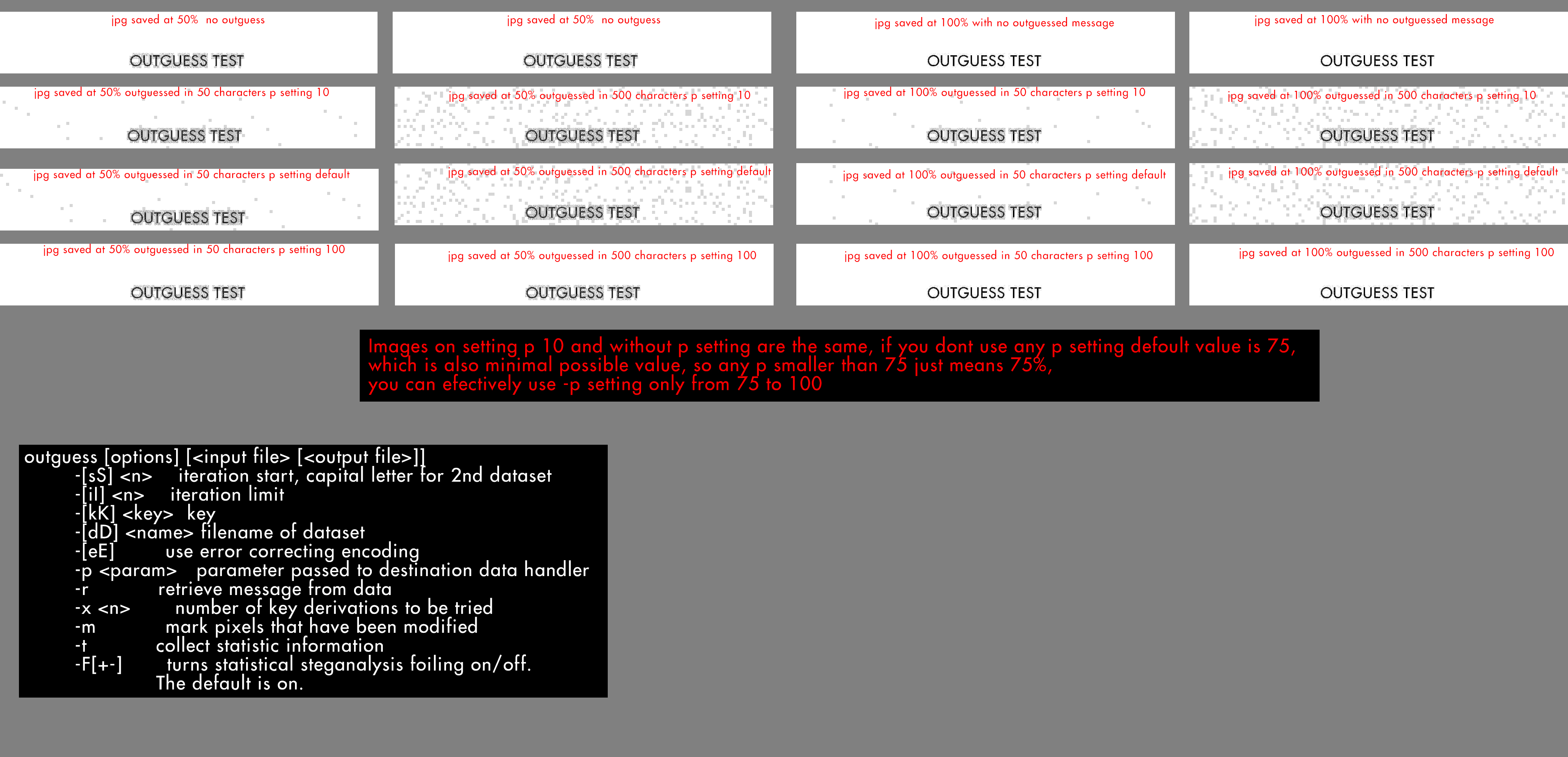

Conditional measures allow expected returns and risk to vary with the state of the economy. The program relies on data specific handlers that will extract redundant bits and write them back after modification. The nature of the data source is irrelevant to the core of OutGuess. It has handlers for image files in the common Netpbm and JPEG formats, so it can, for example, specifically alter the frequency coefficients of JPEG files. OutGuess is a universal steganographic tool that allows the insertion of hidden information into the redundant bits of data sources.

OUTGUESS REVIEW SOFTWARE

We show that the conditional approach addresses one major shortcoming of the traditional approach (risk stability assumption). OutGuess is a steganographic software for hiding data in the most redundant content data bits of existing (media) files. Also, I've run it even after downloading, and it looks nothing like what I've seen online. After, I tried running outguess -r input.jpg output.txt and the error Cant open input file input.jpg: fopen: Permission denied shows.

OUTGUESS REVIEW UPDATE

We discuss their weaknesses and distinguish between traditional performance measures and more recent conditional performance measures. I wanted to try the old puzzles for myself, but when I try to download outguess, I get warned that it's malware. Viewed 79 times 0 So far I was able to get outguess installed on my Ubuntu distribution running under WSL by running sudo apt-get update and then sudo apt-install -y outguess. Portfolio Performance, Traditional Measures, Conditional Performance Measures, Asset Selection, Market Timing, Jensen Alpha, Conditional AlphaĪmerican Journal of Industrial and Business Management,ĪBSTRACT: This study provides a review of the main measures of portfolio performance. Portfolio Performance Measurement: Review of Literature and Avenues of Future Research (1966) Can Mutual Funds Outguess the Market? Harvard Business Review, 44, 131-136. The empirical study reveals that on average, Chinese equity fund managers can bring about 0.58 excess return per year when timing the aggregate stock market, but it is not significant at any reasonable levels.

0 kommentar(er)

0 kommentar(er)